OPINION: A college girl’s guide to financial aid

It’s that time of year again. Yes, the time to fill out that long and terrible document known as the Free Application for Federal Student Aid (FAFSA).

That also means sitting at the dining table with your parents — arguing over what you’re supposed to put, worrying that you are about to commit tax fraud. If you’re anything like me, it also means crying.

The FAFSA is probably one of the most frustrating things you will do for college. On top of that, you also have to renew it every year.

FAFSA opened Oct. 1. Fill out your FAFSA people. It is going to be so helpful with the cost of school.

You might be asking, why do I need to do that? Or saying you don’t want to. Student loans aren’t something to be afraid of or ashamed to have.

First, take a deep breath. It is not the end of the world if the FAFSA is difficult. You will get through it, and there are people who can help you.

Applying early is going to get you the best loan possible. If you haven’t already, apply right now. Trust me, you just need to start it and get it over with.

Read the questions carefully. They sound really complicated, but most of the time they just want an amount that was on your taxes.

If you can’t put the information in from the IRS automatically, don’t stress. Both times I have done it, I had to input the information manually. It takes a little bit longer, but it works just as well.

Don’t rush it. Take your time filling it out. Answer everything you need to, but don’t be discouraged if some questions are left blank or have zero. It’s completely normal to not apply to all of the questions.

Make sure to have all of your tax documents, W-4 and banking information with you. You will most likely need to use all of it.

The most important thing is to not get too anxious over the process. I’m not going to say it’s easy, it isn’t. You just have to do it at your own pace, so you don’t overwhelm yourself.

FAFSA seems like a big scary thing, but once you figure it out you’ll be glad you did it.

There will also come a time when you will see what company is loaning you the money. This is when you’ll start setting up a payment process.

There are two main types of loans, subsidized and unsubsidized. Basically unsubsidized loans collect interest while you are in college, this is the one you can make payments on during school. Subsidized doesn’t start collecting interest until six months after you graduate.

It’s important to pay attention to the loans you receive. You will get all that information once your loans are assigned. Wichita’s Office of Financial Aid is happy to help you if you still have questions or are confused about the whole process.

Don’t be afraid to go talk to them. They are open 8 a.m. to 5 p.m. every weekday. Visit them in Jardine Hall room 203 or give them a call at (316) 978-3430.

Go file your FAFSA. The sooner you get through the pain of it, the better your loans will be.

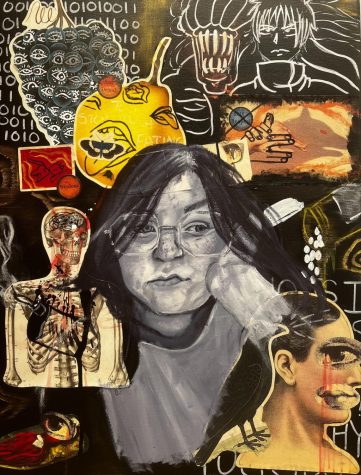

Danielle Wagner was a reporter for The Sunflower. Her favorite quote is by Kristen Costello: "And one day the girl with the books became the woman writing...

Wren Johnson is an illustrator for The Sunflower. Johnson is a third-year communications major that loves chickens. In her free time she likes to read,...